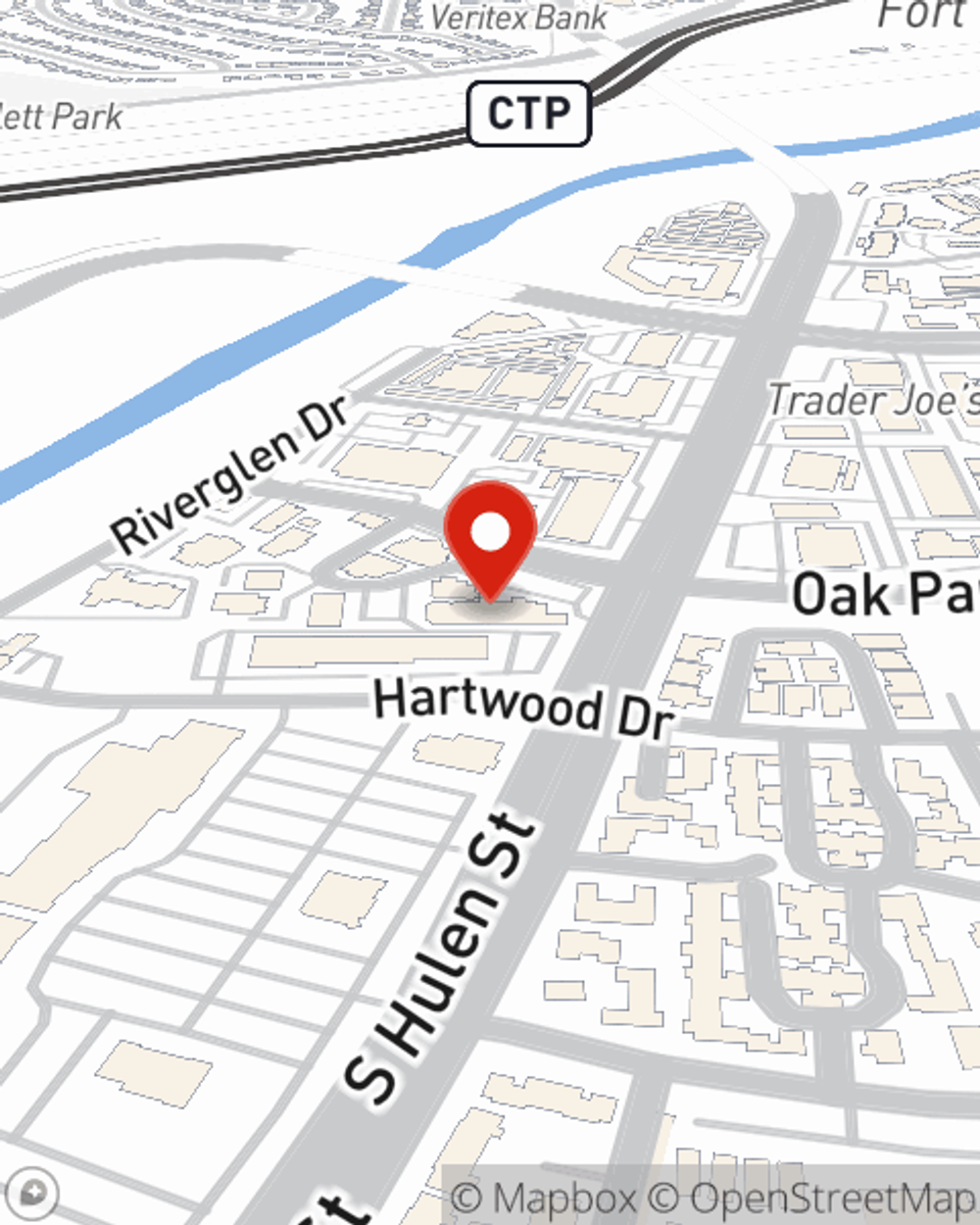

Business Insurance in and around Fort Worth

Looking for small business insurance coverage?

Helping insure businesses can be the neighborly thing to do

- FORT WORTH

- TCU

- BENBROOK

- ALEDO

- WILLOW PARK

- WEATHERFORD

- WHITE SETTLEMENT

- RIVER OAKS

Cost Effective Insurance For Your Business.

Though it's not a pleasant thought, it is good to recognize that some things are simply out of your control. Catastrophes happen, like a staff member gets hurt on your property.

Looking for small business insurance coverage?

Helping insure businesses can be the neighborly thing to do

Insurance Designed For Small Business

Protecting your business from these possible mishaps is as easy as choosing State Farm. With this small business insurance, agent Earl Wood can not only help you construct a policy that will fit your needs, but can also help you submit a claim should a mishap like this arise.

Ready to investigate the specific options that may be right for you and your small business? Simply visit State Farm agent Earl Wood today!

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Earl Wood

State Farm® Insurance AgentSimple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?